indiana estate tax return

Experienced real estate investors should always have a plan in place to avoid or at least minimize capital gains taxes. Those who need an actual copy of a tax return can get one for the current tax year and as far back as six years.

Filing Taxes For Deceased With No Estate H R Block

Income Tax Return for Estates and Trusts.

. 8939 historical form only Department of the. North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later. Elimination of Form ST-136A Indiana Out-of-State Purchasers Sales Tax Exemption Affidavit.

Delivery and Installation Charges Subject to Indiana Sales and Use Tax. For example in 2016 a full year Illinois resident works the entire year in Munster Indiana Lake County. Property taxes in Indiana.

Permanent resident in 2019. The Homestead Standard Deduction reduces the taxable property value by the. Investments in a Qualified Indiana Business.

These forms are available on the Forms Instructions and Publications page on IRSgov. April 2017 - Vol. They use Form 4506-T to request other tax records.

This Certification Letter must be submitted with the investors Indiana state tax return to claim the tax credit. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. Who will be impacted.

Tara writes and lectures frequently on issues affecting individuals with disabilities and their families. By state law property tax collections on primary residences and surrounding property up to one acre are capped at 1 of a homes market value. Tax account transcript record of account wage and income and verification of non-filing.

With a basic understanding of how taxes work in real estate investors can take advantage of money-saving tax strategies to reduce their tax burden and increase overall return. The Indiana Department of Local Government Finances modernization effort includes the Personal Property Online Portal Indiana PPOP-IN which is the online service portal for customers to use when filing business personal property filings with their countytownship assessor. How Property Taxes Work in Indiana.

25 of the investment amount eg 25000 tax credit available for a. The employer is required to withhold Indiana state income tax from the employees wages at the enacted Indiana state income tax rate of 330 plus the applicable Indiana county income tax rate Lake County 050 for wages earned. Assessor Jay County Assessor Jay County Courthouse 1st Floor 120 North Court St Portland IN 47371 Phone 260 726-4456 Fax 260 726-6964.

Real estate owners in the state of Indiana must pay taxes on their property every year. Indianas sales tax rates for commonly. There are also a number of property tax deductions available in Indiana.

Department of the Treasury Internal Revenue Service Center Kansas City MO 64999. Search for Jay County real property and personal property tax records and parcel maps by owner name address tax map number parcel number or legal description. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed Department of the Treasury Internal Revenue Service Stop 824G 7940 Kentucky Drive Florence KY 41042-2915.

Similar to a Form 1040 on. It later turned around and repealed the tax again retroactively to January 1 2013. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws.

Delivery and Installation Charges Subject to Indiana Sales and Use Tax. Tennessee repealed its estate tax in. The amount of the tax credit available to an investor under the Indiana VCI Program in each calendar year is.

Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. As in most other states the Indiana property tax is ad valorem meaning its based on the value of property. Boats and real estate sales may also vary by jurisdiction.

You can learn more about how to collect and file your Indiana sales tax return at the 2022 Indiana Sales Tax Handbook. You were married at the end of 2019 and are not submitting information here with your spouse. The Indiana sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the IN state tax.

You have already filed a 2019 federal income tax return. She practices in the areas of Special Needs Planning Elder Law and Trust and Estate Planning and Administration. Taxes can be divided into two annual installments with one being due on May 10 and the other on November 10.

Your 2019 gross income exceeded 12200 24400 for a married couple or other reasons require you to file a 2019 federal tax return. Terms and conditions may vary and are subject to change without notice. You were not a US.

Indiana Property Tax. New Jersey phased out its estate tax in 2018. Replaced by Sales Tax Information Bulletin 92.

Form 1041 is the US.

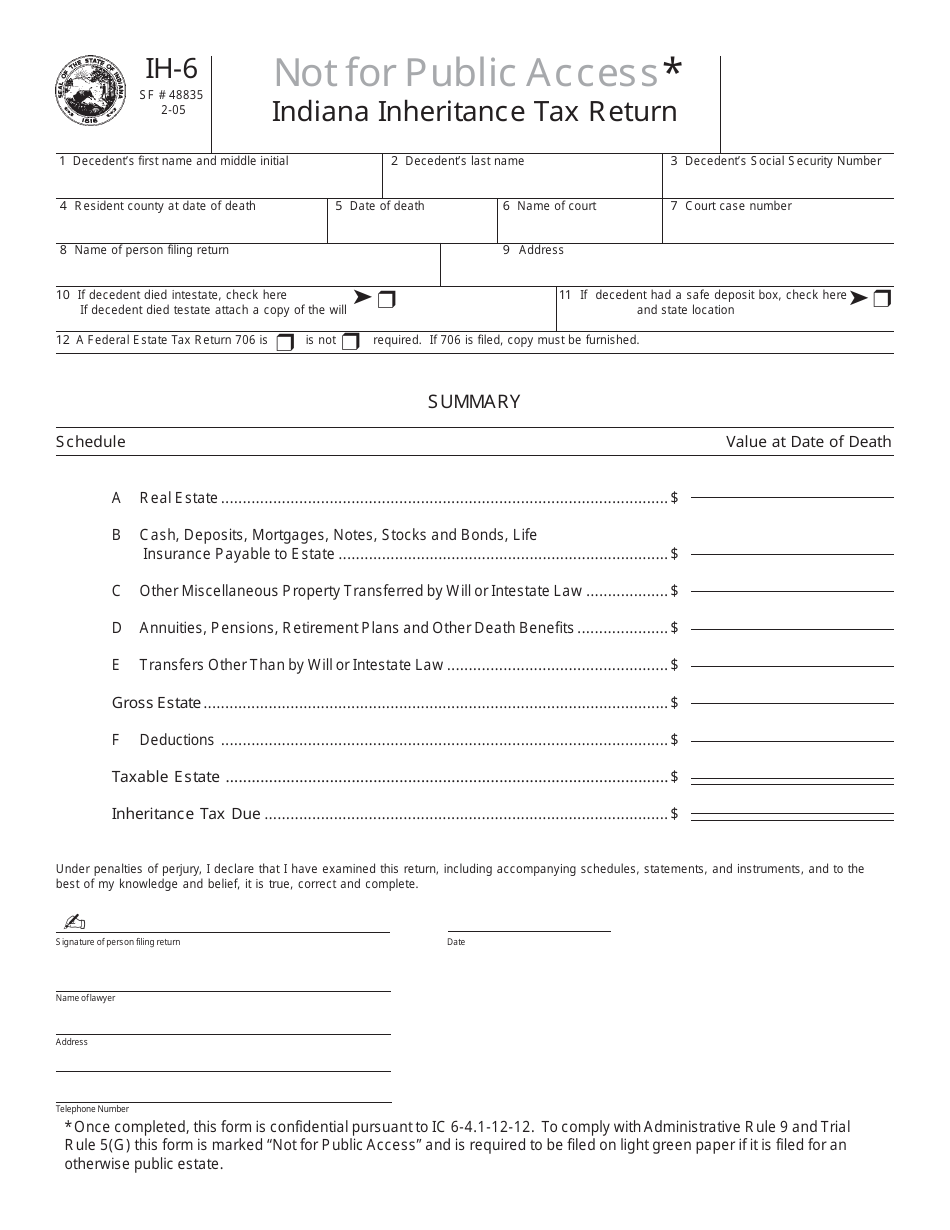

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Eli Manning Lists Giant New Jersey Estate For 5 25m

2021 Estate Income Tax Calculator Rates

Tax Form Templates 5 Free Examples Fill Customize Download

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

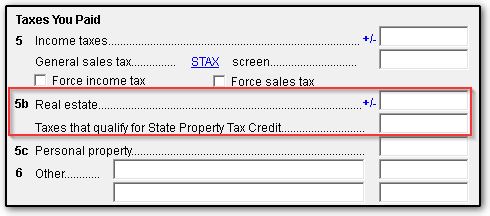

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

How To File Income Tax Return For Nri In A Few Simple Steps Ebizfiling

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

When Is It Safe To Recycle Old Tax Records And Tax Returns

How To File Taxes For Free In 2022 Money

Free And Discounted Tax Preparation For Military Military Com

How To File Llc Taxes Legalzoom

Waiting On Tax Refund What Return Being Processed Status Really Means Gobankingrates

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

Will The Irs Extend The Tax Deadline In 2022 Marca